Extra Features

The Dashboard is organized by the most common

workflows used to manage your business. For

example, the Transactions' section includes

everything you need to manage the flow of money

in and out of your account.

In many cases, you can use the Dashboard to

perform specific actions, such as refunding a

payment or canceling a subscription, without

needing to use the API—making the Dashboard a

useful tool for running your business.

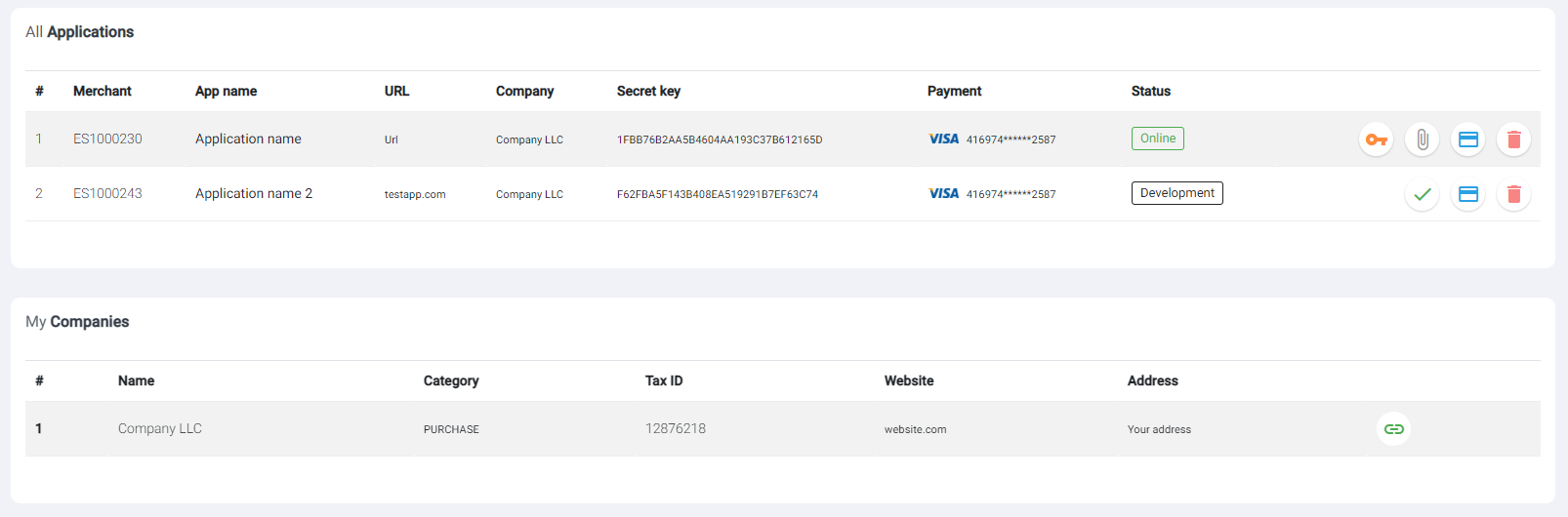

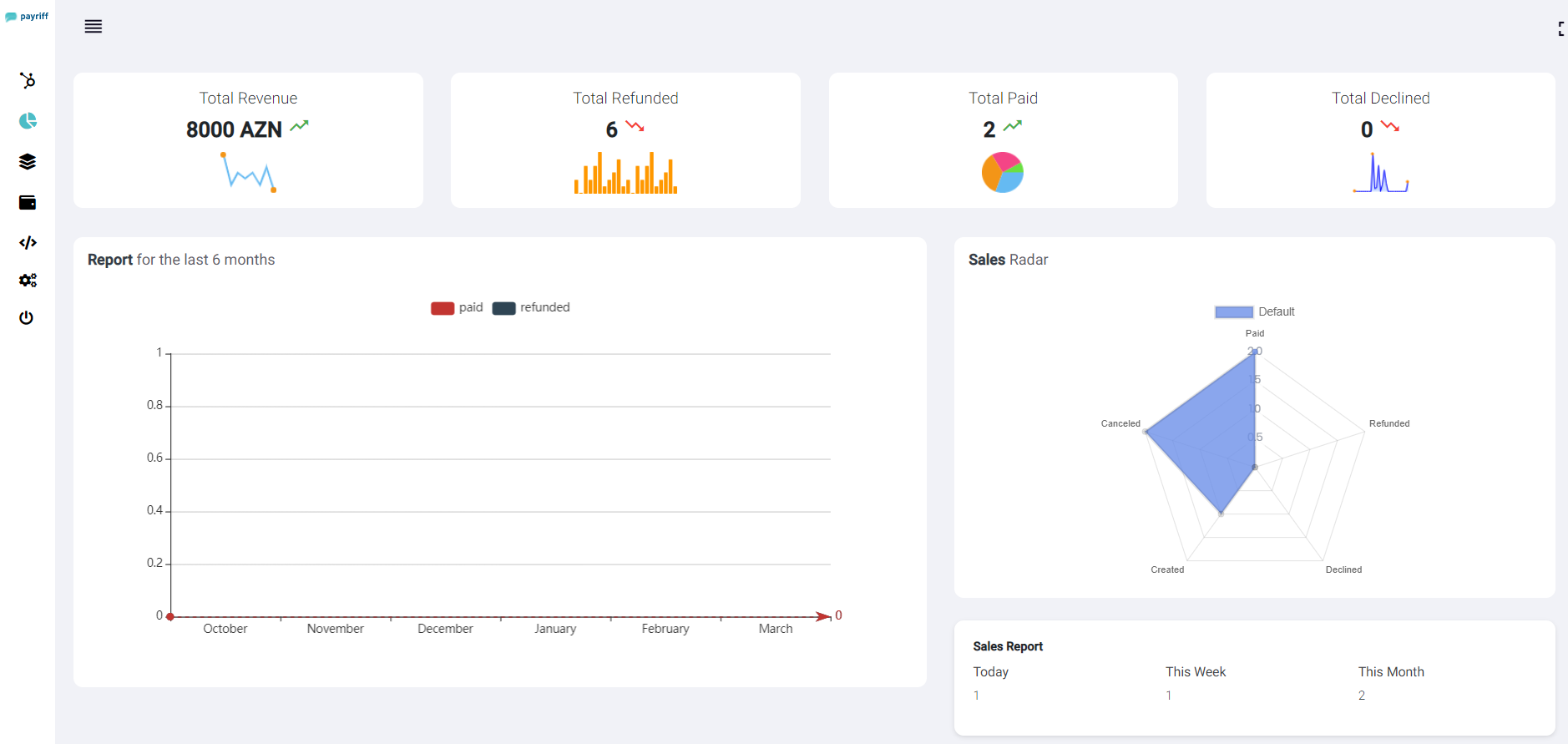

Dashboard

The PayRiff Dashboard is a feature-rich user

interface for you to operate and configure your

PayRiff account. You can use it to manage

payments and refunds, respond to dispute,

monitor your integration, and more.

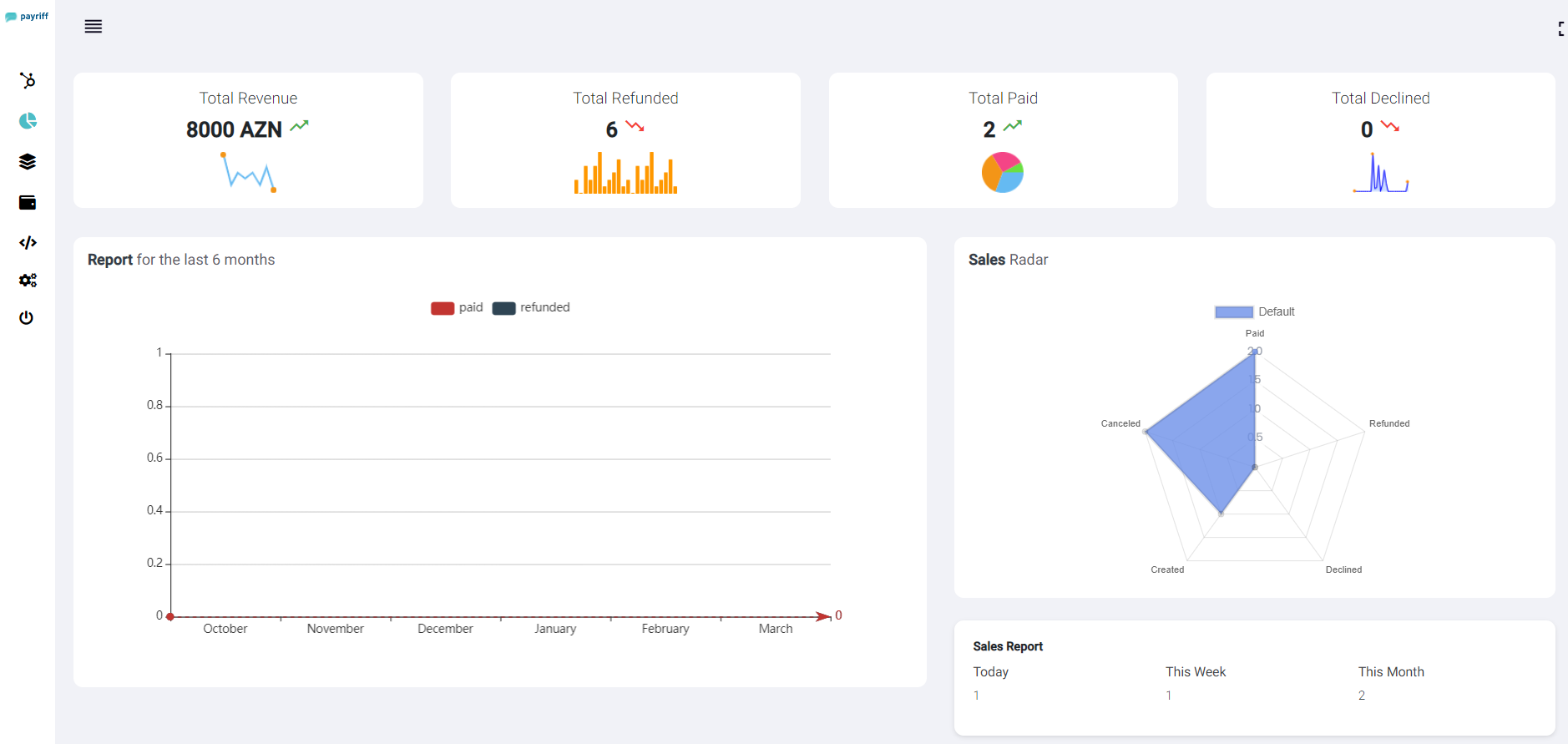

Home provides useful at-a-glance information

about the activity on your account. A wide range

of analytics and real-time charts provide

insight into the performance of your business.

Home also shows recent activity that may require

you to take action, such as unanswered disputes

or identity verifications.

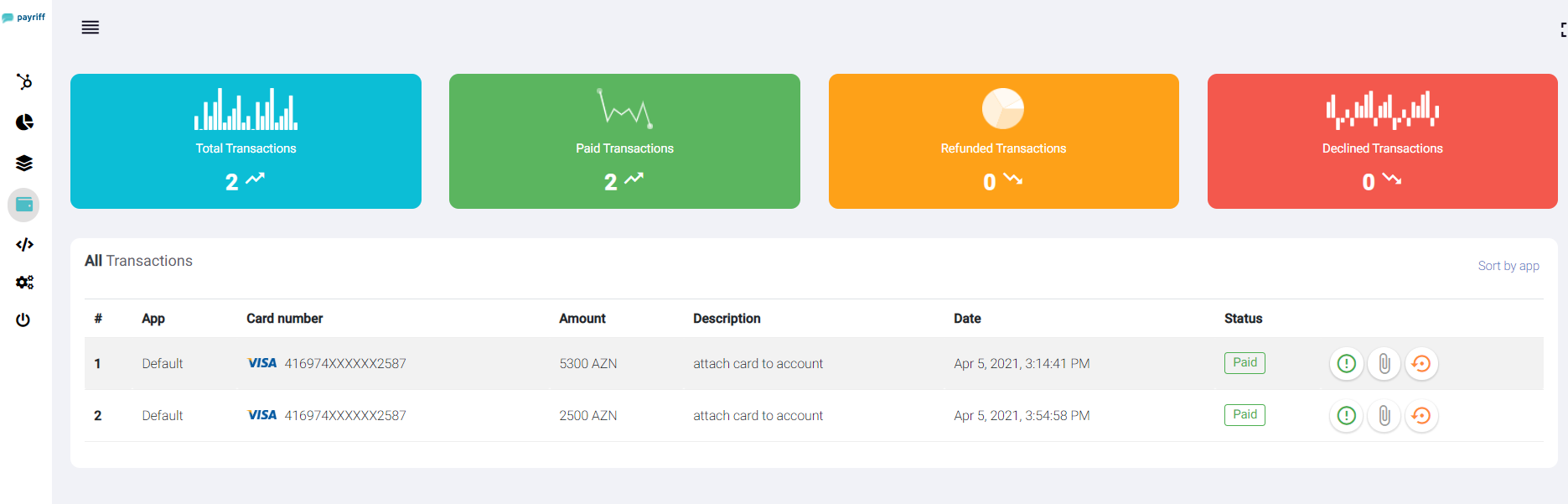

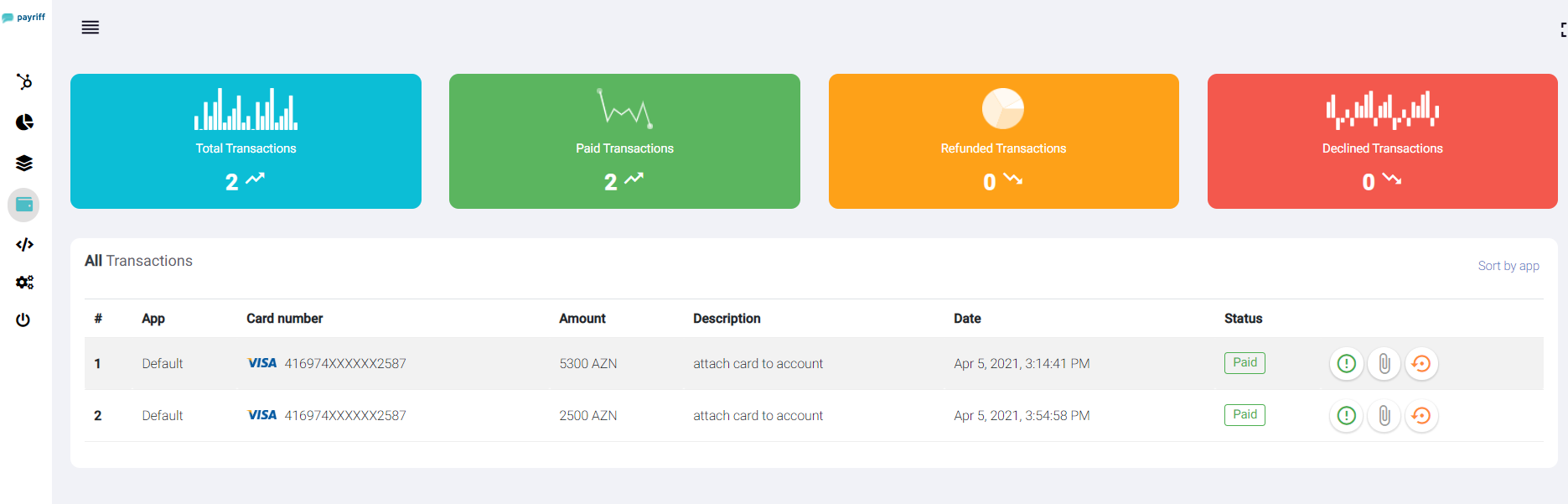

Transactions

Transactions

section includes everything you need to manage

the flow of money in and out of your account.

You can use the transactions to perform specific

actions, such as refunding a payment or

canceling a subscription, without needing to use

the API.

Creating reports and searches

All of your transactional data can be filtered

and exported as reports in CSV format. You can

also download the report. The Dashboard search

can be used to find specific information using

search terms and operators, find a specific

payment using the customer's email address or

the last four digits of their card number to

narrow down the number of results.

Transactions status

| Parameter |

Description |

CREATED |

Indicates that the operation has

been created.

|

APPROVED |

Successful payment. |

CANCELED |

After canceled payment, the

forwarding address

|

DECLINED |

The operation was refused. |

REFUNDED |

The funds were returned. |

PREAUTH_APPROVED |

Confirmation of pre-authorization is

reported.

|

EXPIRED |

Indicates that the payment page has

expired.

|

REVERSE |

Reverse payment has been made. |

PARTIAL_REFUND |

A partial reversal operation

occurred.

|

Refund

You can refund charges made to your account,

either in whole or in part. Refunds use your

available PayRiff balance—this doesn't include

any pending balance. If your available balance

doesn't cover the amount of the refund, PayRiff

debits the remaining amount from your bank

account.

*If PayRiff can't debit the remaining amount

from your bank account, your refunds may go into

a pending status until you add funds to your

PayRiff balance. You can view a list of all your

pending refunds in the Dashboard. If the

original charge underwent currency conversion,

the refunded amount converts back using the same

process. There are no fees to refund a charge,

but the fees from the original charge aren't

returned.

Refunds can be issued via the

API

or the

Dashboard

and are processed immediately. Once issued, a

refund cannot be canceled.

Using the Dashboard

To refund a payment via the Dashboard:

-

Find the payment to be refunded in the

payments overview page

Transactions.

-

Click the button

Refund to the

right of the charge.

-

By default, you will issue a full refund.

For a partial refund, enter a different

amount to be refunded.

- Click

Refund.

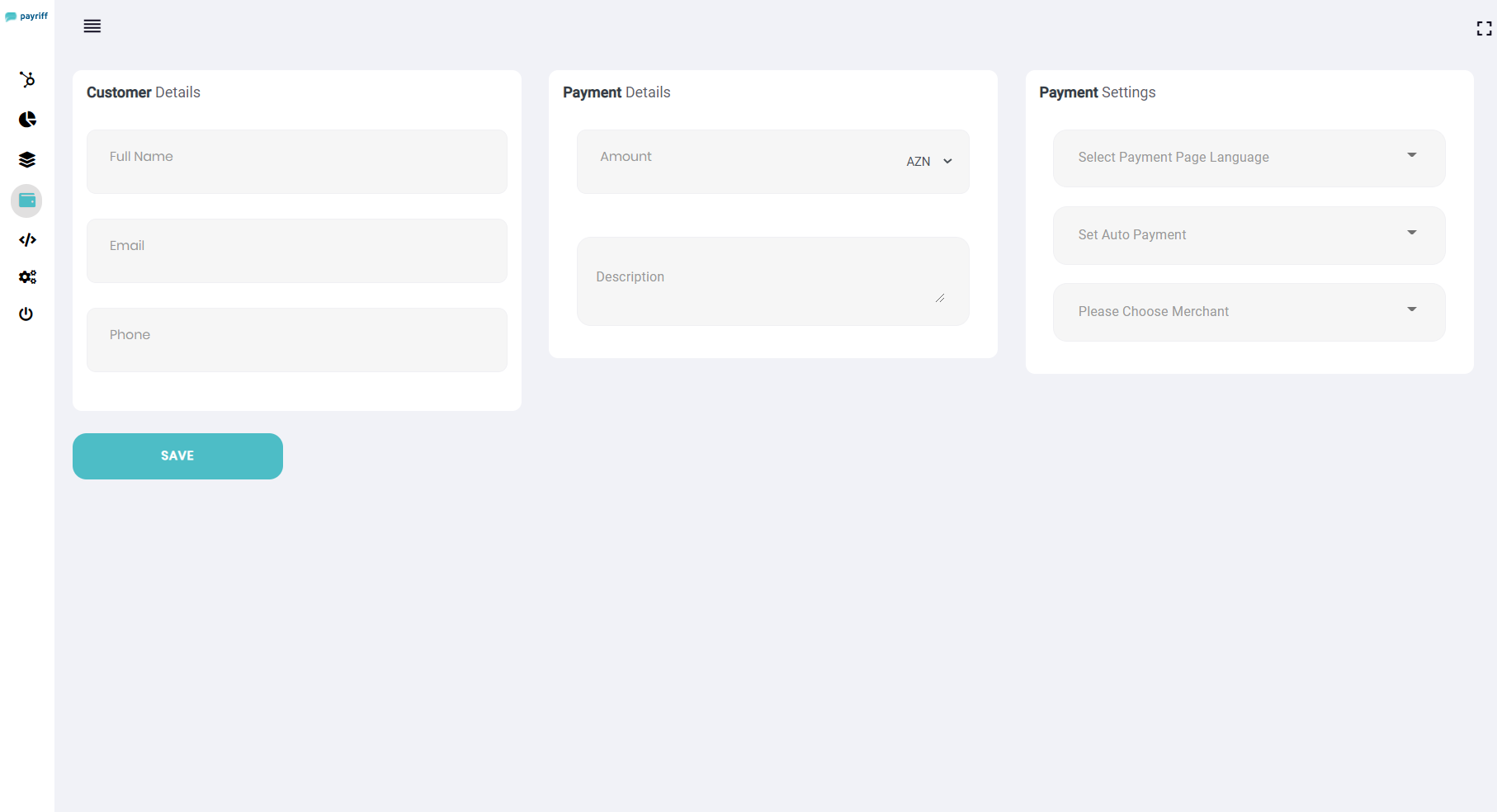

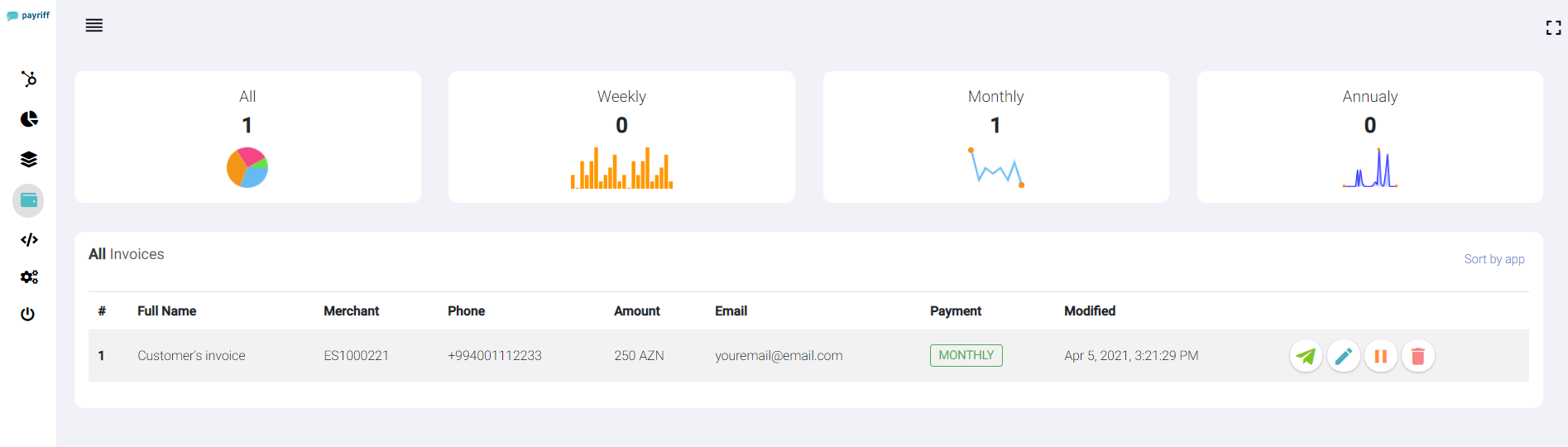

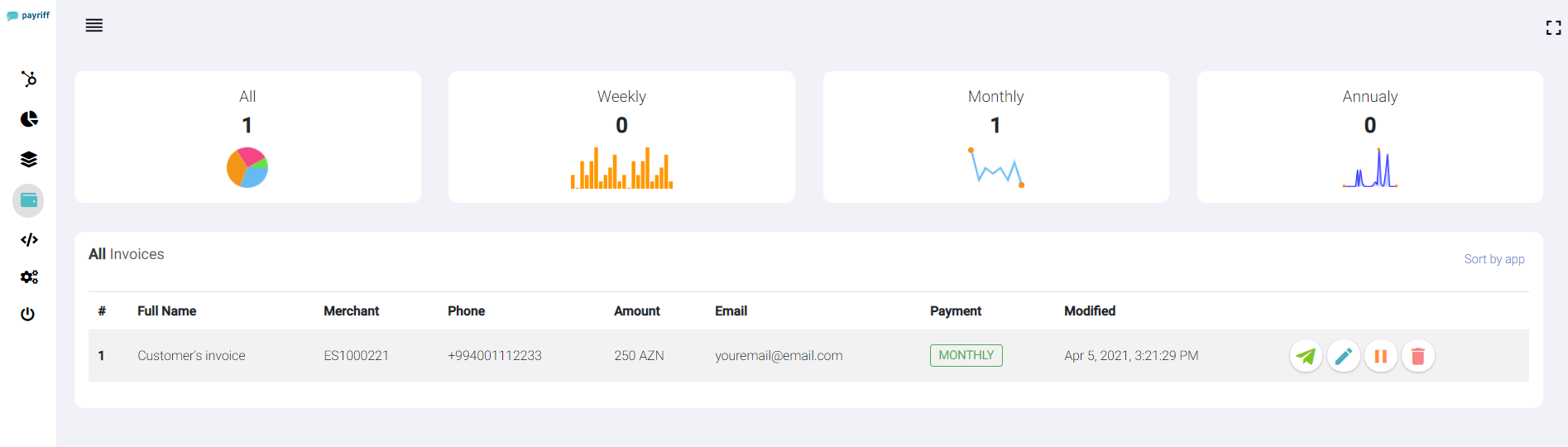

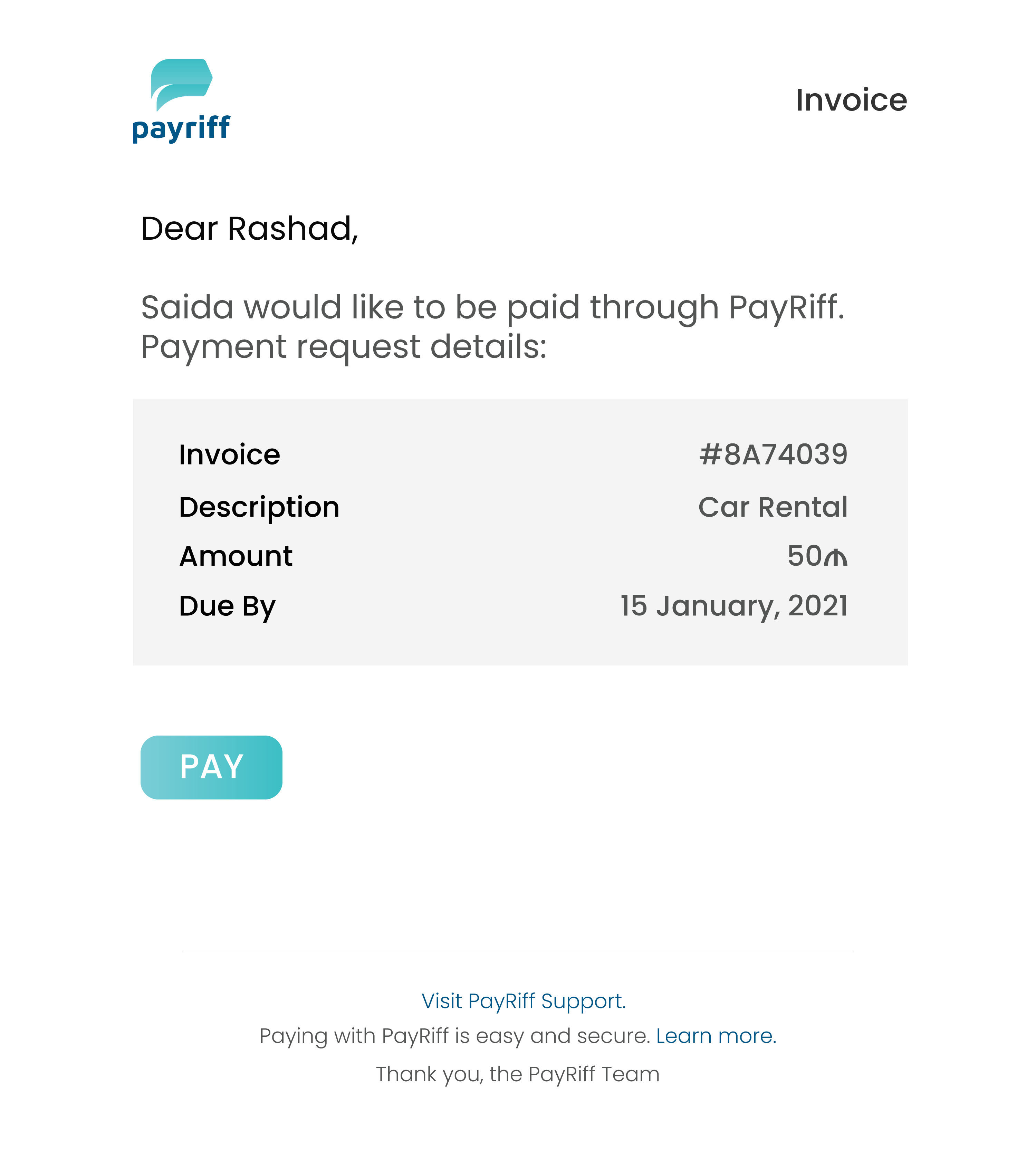

Online Invoicing

With PayRiff, you can

send invoices

online

to your customers through the click of a button

even if you don't have a website. Accept instant

payments from your customers via credit or debit

card with our online invoicing solution.

This guide describes how to create an invoice

and collect payment. You can also use them as a

tool to collect payment. Businesses that aren't

subscription based but still need to send

invoices to their customers commonly use one-off

invoices. For example, a consulting business

might send invoices for the time and resources

that each consultation uses.

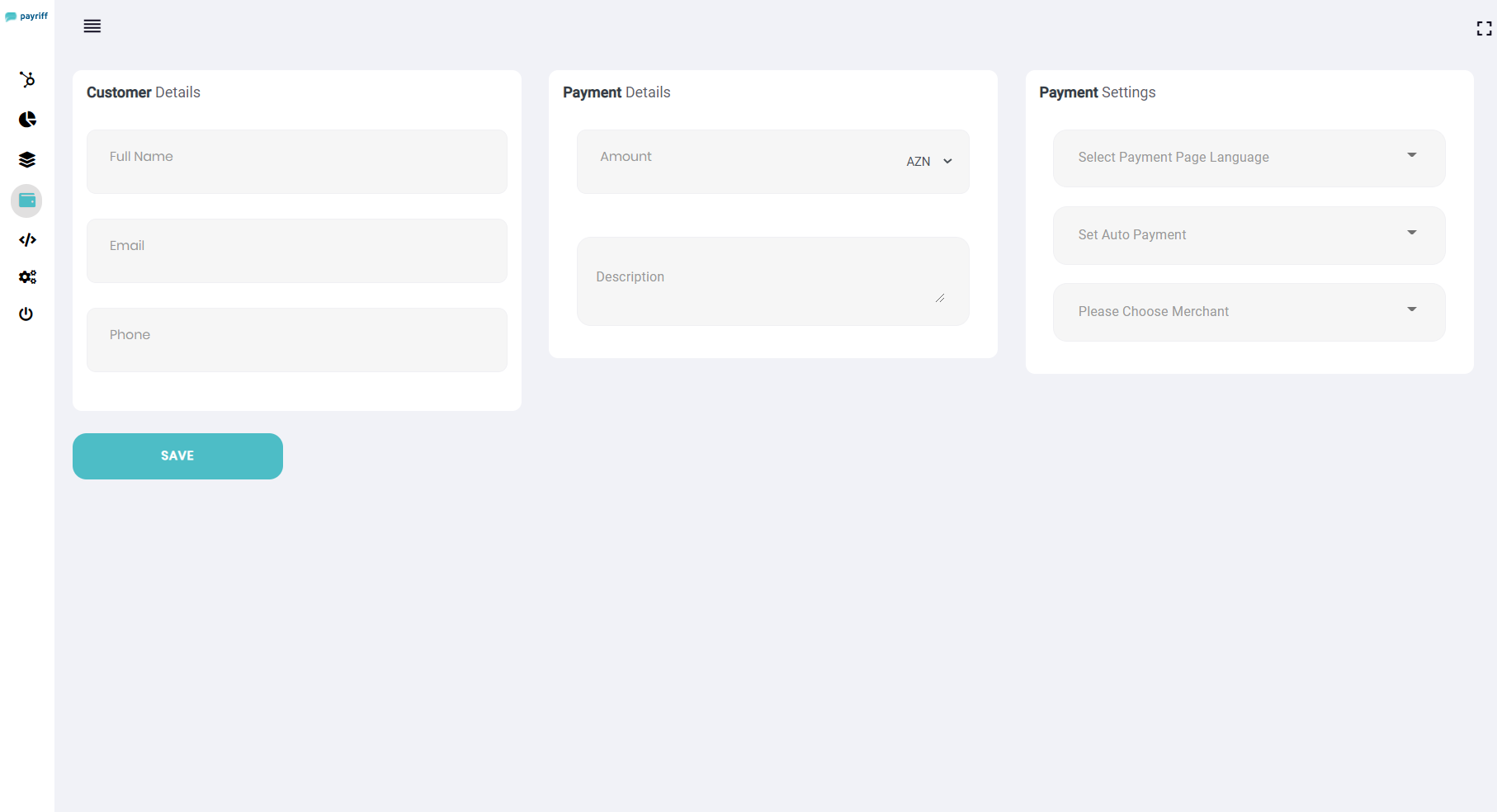

To create an invoice in the PayRiff Dashboard:

-

Navigate to the

Create

an

invoice

page.

-

Fill out the

Customer details, Payment details, and Payment settings fields

and click Save.

-

Verify the email address, but you can modify

it if you want to use a test email address.

-

Navigate to the

Invoices

page and click

Send Invoice.

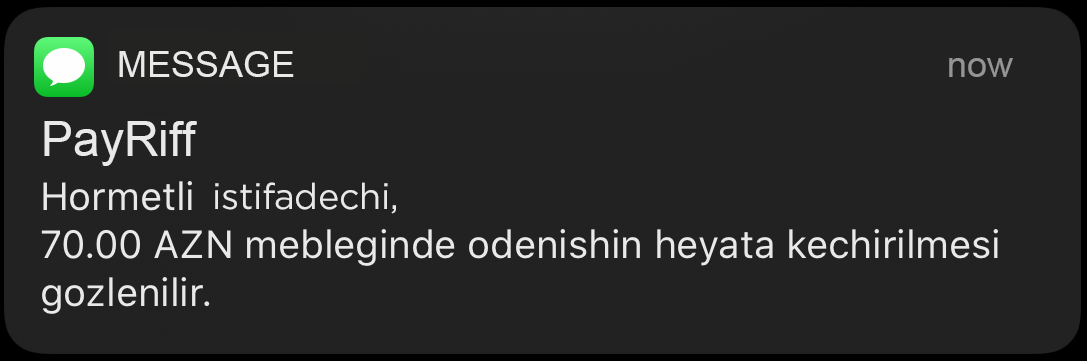

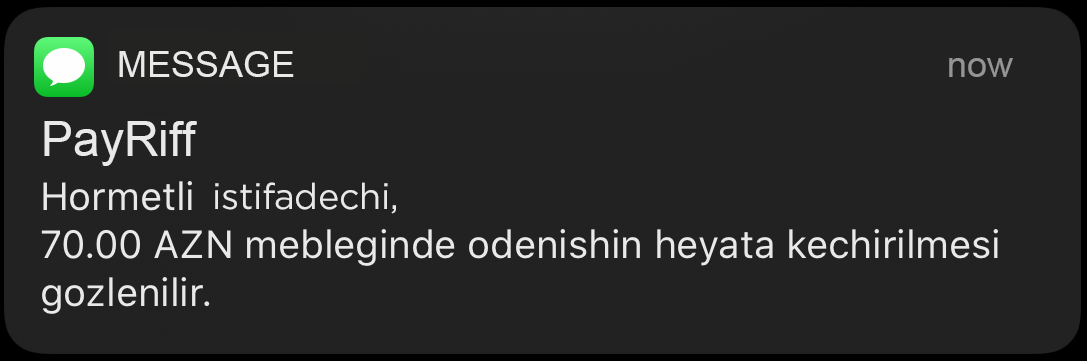

Customer notification via SMS:

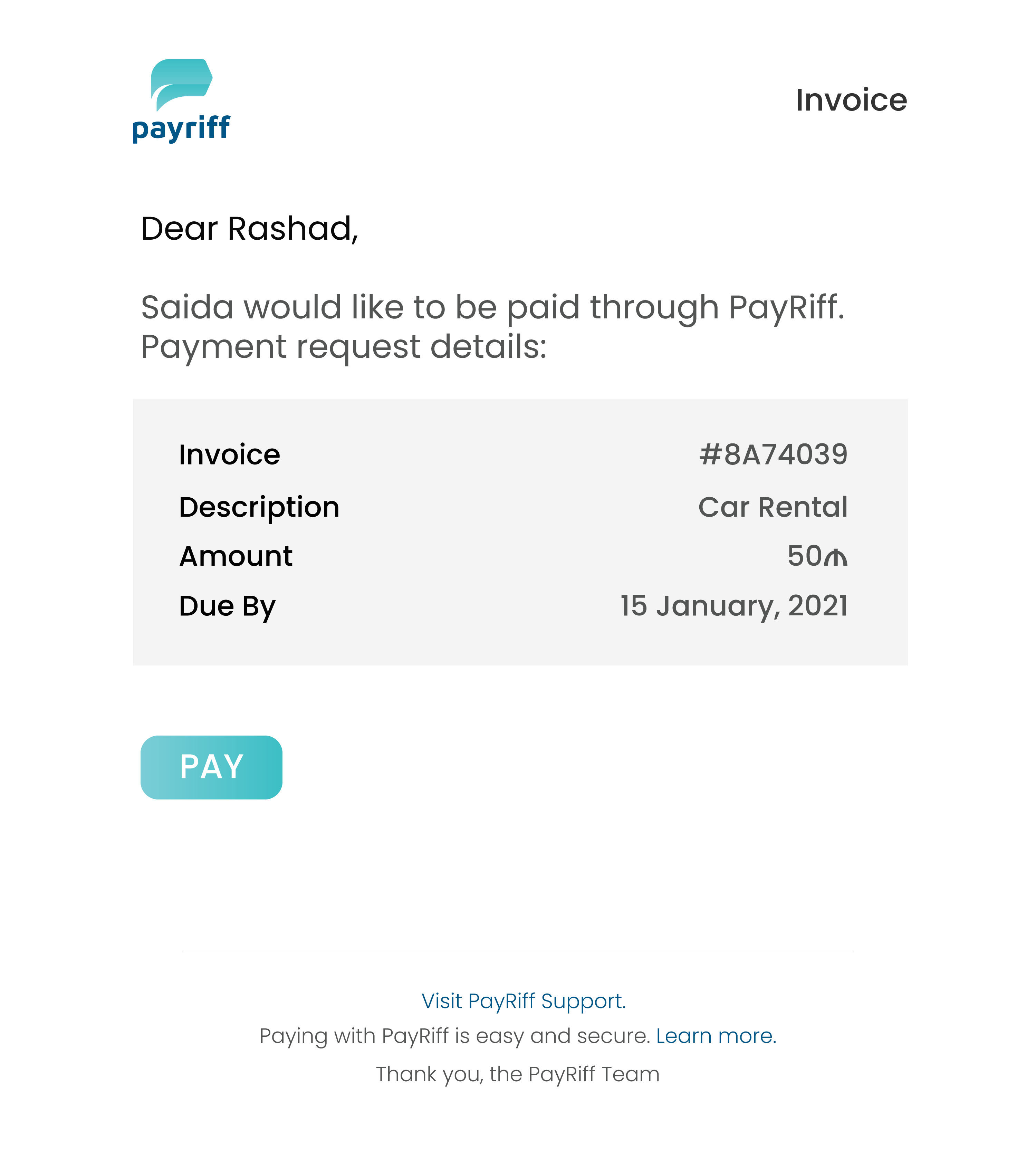

Customer notification via Email:

The PayRiff Dashboard is the most common way to

create one-off invoices but you can automate

this process if you integrate with the API.

Recurring Payments

Easily manage the entire customer lifecycle from

accepting recurring payments to managing

customer subscriptions.

cardSave

POST

{

"body": {

"amount": 4,

"approveURL": "https://payriff.com/approve",

"cancelURL": "https://payriff.com/cancel",

"declineURL": "https://payriff.com/decline",

"currencyType": "AZN",

"description": "Card save description",

"directPay": true,

"language": "AZ"

},

"merchant": "ES10901XX"

}

{

"code": "string",

"internalMessage": "string",

"message": "string",

"payload": {

"orderId": "string",

"paymentUrl": "string",

"sessionId": "string"

}

}

| Parameter |

Description |

amount |

Payment amount to block |

approveURL |

After successful payment, the

forwarding address.

|

cancelURL |

After canceled payment, the

forwarding address

|

declineURL |

After declined payment, the

forwarding address

|

currencyType |

Currency of payment (AZN, USD, EUR)

|

description |

Payment description for customer

|

language |

Payment page language (AZ, EN, RU)

|

merchant |

Your unique merchant number |

*If the parameters approveUrl,

cancelUrl,

declineUrl are left blank, then we

will automatically redirect to

Success,

Cancel,

Decline

Using this method, you can save a credit card

during the payment process so that you can use

it in further automatic operations.

You first need to make some payment using this

method, if the transaction was successful, we

return a POST request for

approveURL, parameter

cardUuid, you can save it in the

database, and then later using the

autoPay method, set the

request parameter to thecardUuidparameter and

payment will be made, with a saved customer

card.

{

"code": "string",

"internalMessage": "string",

"message": "string",

"payload": {

"orderID": "11154555",

"sessionID":"75B00D99650XXXXXXXXXXXXXAEB8",

"transactionType": "",

"purchaseAmount": "1",

"currency": "840",

"tranDateTime": "11/11/2020 17:00:19",

"responseCode": "001",

"responseDescription": "Approved, no balances available",

"brand": "VISA",

"orderStatus": "APPROVED",

"approvalCode": "325111 A",

"acqFee": "0",

"orderDescription": "Item description",

"approvalCodeScr": "335111",

"purchaseAmountScr": "0.01",

"currencyScr": "USD",

"orderStatusScr": "TƏSDİQLƏNİB",

"cardRegistrationResponse": "",

"rrn": "259990XX7X",

"pan": "416973XXXXXX5555",

"cardHolderName": "",

"cardUID": "42EDEXXXXXXXXXX80D70050XXXXX4BCX"

}

}